Despite global cost of living pressures and elevated interest rates, Victoria’s economy is continuing to grow and expand – adding new goods and services, while the number of Victorians in jobs is at near-record levels.

The Victorian economy is estimated to be almost 14% larger in real terms in 2024-25 than it was in 2018-19 before the COVID-19 pandemic. And over the last decade, Victoria’s economy has grown faster than any other state.

Businesses are voting with their feet and they’re voting for Victoria – they are continuing to choose Victoria as a place to invest and do business.

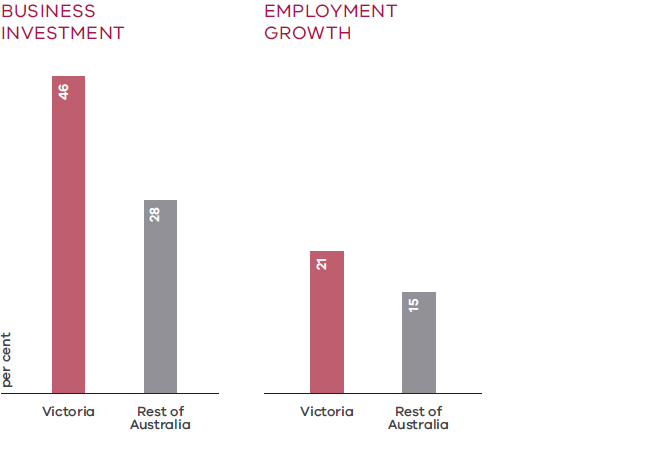

Since the peak impacts of the pandemic in September 2020, Victorian business investment has increased by 46%, compared with 28% in the rest of the country.

Over the past year alone, investment grew by 3.7%, compared to a 1.3% fall across the rest of Australia.

More than 113,000 new businesses have been created in Victoria in the past 5 years – an 18% increase, the largest percentage growth of any state.

Victoria’s economic strength has resulted in 648,800 Victorians finding a job since the peak of the pandemic in September 2020, rising by more than 20% – more than any other state over the same period.

Over the past year alone, a further 85,800 Victorians have found work – and forward indicators point to this trend continuing.

Note:

Growth in employment is from September 2020 to March 2025; growth in business investment is from the September quarter 2020 to the December quarter 2024 (the latest data available).

Victoria’s economic outlook also remains positive, with economic growth forecast to strengthen in 2025-26 to 2.50%.

With inflation returning to lower levels, wages are forecast to grow faster than inflation in 2024-25 for the first time since the pandemic. Further expected easing in interest rates will also provide much-needed relief for household budgets.

Strong economic growth, low unemployment and record business investment mean Victoria is well-placed to face the global challenges ahead – and to continue creating jobs and economic opportunities to benefit all Victorians.

General government fiscal aggregates

| Unit of measure | 2023-24 actual | 2024-25 revised | 2025-26 budget | 2026-27 estimate | 2027-28 estimate | 2028-29 estimate | |

| Net result from transactions | $ billion | (4.2) | (3.4) | 0.6 | 1.9 | 2.4 | 1.5 |

| Net cash flows from operating activities | $ billion | 2.6 | 0.6 | 6.2 | 7.9 | 6.6 | 5.8 |

| Government infrastructure investment (a)(b) | $ billion | 24.2 | 23.8 | 21.3 | 18.8 | 15.9 | 15.6 |

| Net debt | $ billion | 133.2 | 155.5 | 167.6 | 177.4 | 185.2 | 194.0 |

| Net debt to GSP (c) | % | 22.0 | 24.5 | 25.1 | 25.2 | 25.0 | 24.9 |

Source: Department of Treasury and Finance

Notes:

(a) Includes general government net infrastructure investment and the estimated cash flows of public private partnership projects.

(b) Includes the estimated private sector construction-related expenditure associated with the North East Link held in the public non-financial corporations (PNFC) sector.

(c) The ratios to gross state product (GSP) may vary from publications year to year due to revisions to the Australian Bureau of Statistics GSP data.

Victorian economic forecasts (a)

2023‑24 | 2024‑25 | 2025‑26 | 2026‑27 | 2027-28 | 2028-29 | |

| Real gross state product | 1.5 | 2.00 | 2.50 | 2.75 | 2.75 | 2.75 |

| Employment | 3.4 | 2.50 | 0.50 | 1.50 | 1.75 | 1.75 |

| Unemployment rate (b) | 4.0 | 4.50 | 4.75 | 4.75 | 4.75 | 4.75 |

| Consumer price index (c) | 4.0 | 2.50 | 2.75 | 2.75 | 2.50 | 2.50 |

| Wage price index (d) | 3.6 | 3.25 | 3.25 | 3.25 | 3.25 | 3.25 |

| Population (e) | 2.4 | 1.70 | 1.70 | 1.70 | 1.70 | 1.70 |

Sources: Australian Bureau of Statistics; Department of Treasury and Finance

Notes:

(a) Percentage change in year average terms compared with the previous year, except for the unemployment rate (see note (b)) and population (see note (e)). Forecasts are rounded to the nearest 0.25 percentage points, except for population (see note (e)).

The key assumptions underlying the economic forecasts include interest rates that broadly follow market economists’ expectations; an Australian dollar trade weighted index of 59.6; and oil prices that follow the path suggested by oil futures.

(b) Year average.

(c) Melbourne consumer price index.

(d) Wage price index, Victoria (based on total hourly rates of pay, excluding bonuses).

(e) Percentage change over the year to 30 June. Forecasts are rounded to the nearest 0.1 percentage point.

Growing Victoria’s economy is a crucial element of our fiscal strategy.

A growing economy not only means more jobs – it also reduces net debt as a share of the economy.

It means that while we responsibly manage our spending, we’re also laying the groundwork for an even stronger, more resilient economy.

Victoria has led the states – we're number one in real economic growth, jobs growth, and business investment growth over the last decade.

But we cannot rest on our laurels.

Our Economic Growth Statement lays out our plan to continue building Victoria’s economy by fostering innovation, attracting investment and creating good jobs.

With work well underway to progress all 40 plus of its initiatives, this Budget delivers $240 million to fund the Economic Growth Statement – in full.

Victoria’s Economic Growth Statement

This Budget delivers on the Victorian Government’s Economic Growth Statement, with a package to support our economy, people and businesses to grab the opportunities of the future – with both hands.

These initiatives will make it even easier to start or build a business in Victoria, while continuing to grow our economy. Our Economic Growth Statement is underpinned by 4 key actions:

Backing Victorian businesses and Victorian jobs

At a time of increasing global economic uncertainty, the Victorian Government is backing Victorian businesses and Victorian jobs.

As part of our strategy to grow Victoria’s economy, this Budget delivers $627 million to help businesses find new opportunities to expand and attract investment, and support the Victorian economy.

A $150 million Victorian Investment Fund will grow the sectors that are important to our state’s future. A dedicated $50 million regional stream will make sure that our economic growth and good secure jobs reach every corner of our state.

A further $35 million will deliver programs including one-to-one facilitation and advice for small and medium-sized businesses to boost exports and help them navigate a challenging international trade environment.

This investment will help businesses sell their products around the world and find new customers – including through personalised help from experts. This funding will also support trade missions to continue helping exporters to expand and strengthen their connection to international markets.

The $3 million Small Business Toolkits Program will also support small businesses with advice and capability building, including localised workshops, live webinars, one-on-one confidential business advice and self-guided learning.

And the new $1 million Boosting Business Skills Mentoring program will help up to 1,000 small business owners in priority sectors with dedicated mentoring from an experienced professional.

We are also helping businesses grow, invest, and create more jobs by progressively abolishing stamp duty on commercial and industrial property. Over the next 40 years, this reform is projected to generate 12,600 new jobs and boost Victoria’s economy by up to $50 billion.

More than 3,700 commercial and industrial properties have moved to the new system – meaning businesses won’t be liable for stamp duty when they are next sold. Between 2025-26 and 2028-29, businesses are expected to pay $457 million less in stamp duty.

An additional $459 million will make sure Victorians have the right skills for the opportunities of the future. This includes:

- $171 million to meet training and skills demand, including providing up to 20,000 Victorians with the opportunity to develop new skills or retrain through Free TAFE.

- $121 million for the TAFE services fund, including asset maintenance and support for TAFE students to complete their studies and access job opportunities.

- $44 million will create 9,600 more student places in digital literacy and employability skills training at Learn Local providers, and 8,000 additional student places a year in literacy and numeracy programs at TAFEs, helping Victorians develop these foundational skills and find a job.

- $23 million to strengthen the apprenticeship system and help apprentices and trainees to complete their training.

- $18 million to pilot Aboriginal Community Controlled vocational education and training models, to improve completion rates and grow the First Nations VET workforce.

- $9.3 million to provide scholarships and more professional development opportunities for TAFE and Adult Education teachers, ensuring students gain access to high quality training.

Practical support for small business owners

Whether you’re an entrepreneur learning the ropes of starting a business, or a long-time small business owner, this Budget is supporting small businesses:

- One-to-one trade facilitation support for small and medium-sized businesses scaling up their exports of goods or services.

- Access to more opportunities to win government contracts.

- Business advice through the Small Business Toolkits program.

- Up to 3 one-hour mentoring sessions for 1,000 eligible small business owners in our priority sectors.

Updated