Rising prices at the supermarket, on bills and at the GP are making it harder for many families to make ends meet.

As this cost of living pressure continues, we’re firmly on the side of Victorian families – with this year’s Budget providing real help.

This Budget also provides more funding for frontline services – ensuring families have access to the quality healthcare, education, transport and services they deserve.

We’ve been able to achieve both these objectives because we’ve made responsible choices.

By carefully managing our state’s finances – and reducing government spend on inefficient and non-priority programs – we’ve been able to use our Budget to deliver more of what matters most to Victorian families.

This work has been undertaken consistent with the objectives of the Silver Review, which is helping to ensure Victoria’s Public Service remains focused on meeting the needs of Victorian families.

It means with this Budget, we’re continuing to deliver the biggest investment in frontline staff and services as a share of workforce investment since 2019.

The result: a responsible Budget that delivers real cost of living help for families – and more investment in frontline services.

With this Budget, we’re focused on what matters most.

We're delivering real help with the cost of living and more investment in frontline services. We've been able to achieve both these objectives because we've made responsible choices.

The Silver Review

With the cost of living, families are having to carefully consider every dollar. They rightly expect their Government to do the same.

It’s why the Victorian Government commissioned an independent review of Victoria’s Public Service.

The Review, led by Helen Silver AO, is targeting inefficiency and lower-priority programs – ensuring the public service is focused on the Victorian people and their priorities.

The Review has been:

- Finding overlaps and programs that are no longer fit for purpose that can be streamlined.

- Identifying how departments can work better together, including consolidating agencies to make services easier to access.

- Looking at ways to reduce the public service back towards its pre-pandemic share of employment – particularly the number of executives.

Frontline workers such as nurses, teachers, police officers or child protection workers are not included in the scope of the Silver Review.

The Review’s final report will be delivered to Government by the end of June 2025, but we’ve already undertaken actions consistent with the Review’s objectives as part of the 2025/26 Budget. This includes:

- Corporate savings from non-frontline functions across government, including increasing automation of activities and services, making better use of technology to track and report on procurement spending, and further consolidating accommodation including within the Treasury Precinct.

- Consolidation of duplicative or similar functions across departments and agencies, pooling and strengthening public sector expertise and excellence, to make it easier for the community and industry to engage with government.

- Ceasing or scaling back activities and functions where their original aims have been achieved or the existing level of investment is no longer required to deliver on those aims.

Through this continued work, the Government will ensure every dollar is focused where it matters most: ensuring good schools, good hospitals, safe communities – and real help with the cost of living.

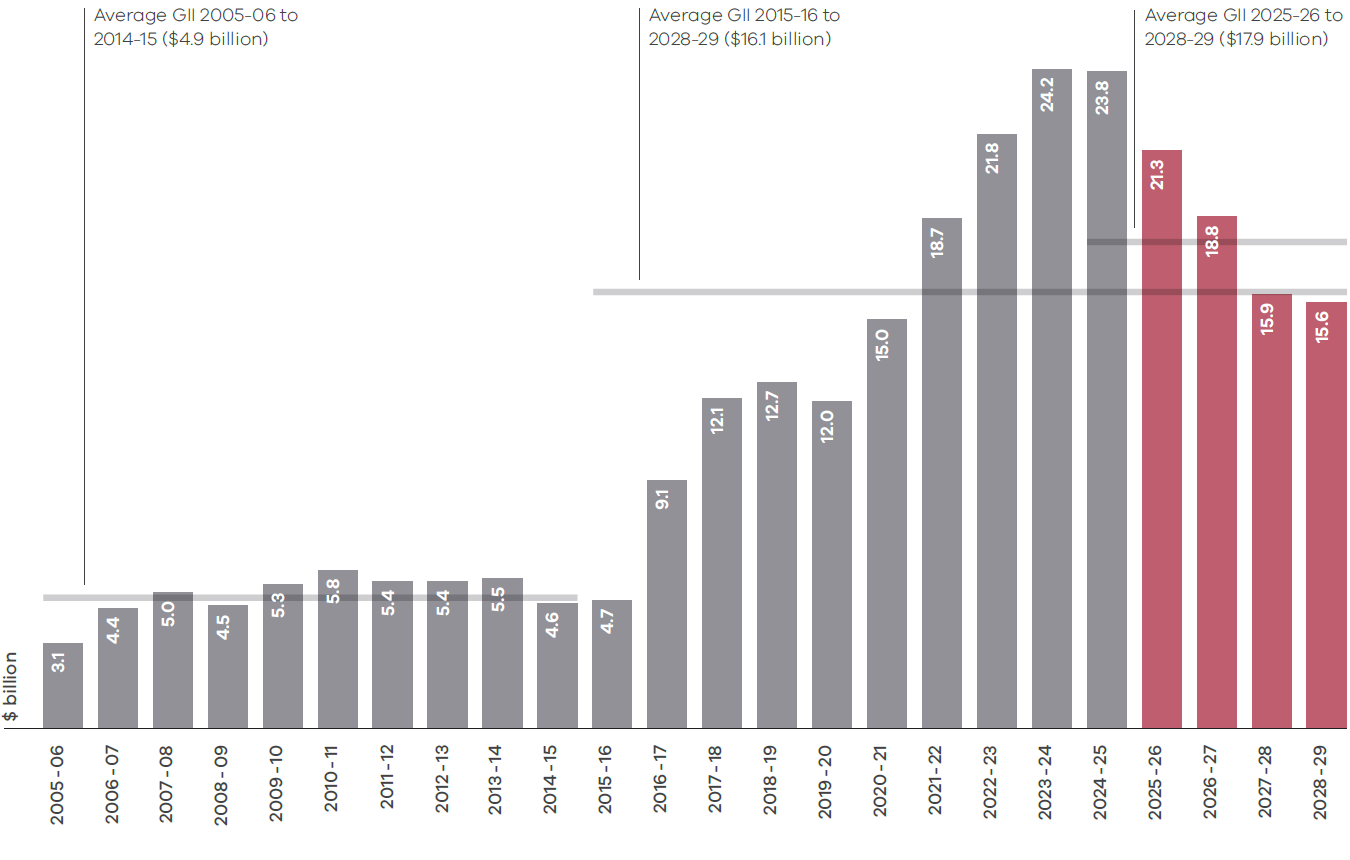

Government infrastructure investment

Major projects coming online in 2025-26 include the Metro Tunnel, West Gate Tunnel, our commitment to 100 new schools by 2026 and final construction of the new Footscray and redeveloped Frankston Hospitals.

These projects will be critical to our growing state – transforming the way Victorians get around and improving access to services and opportunities.

The completion of these projects also enables us to continue progressively returning Victoria’s capital program towards pre-pandemic levels.

We are moderating investment over the forward years – while continuing to deliver the infrastructure and services Victorians need.

Notes:

Includes general government net infrastructure investment and the estimated construction costs of public private partnership projects.

Includes the estimated private sector construction-related expenditure associated with the North East Link held in the public non-financial corporations (PNFC) sector.

Excludes the impact of the medium-term lease over the operations of the Port of Melbourne and the divestment of Victoria’s share of Snowy Hydro Limited.

Delivering on our fiscal strategy

Our responsible approach to budget management also means we’re firmly on track to deliver on our fiscal strategy.

The Budget delivers an operating surplus in the budget year – the first time since before the pandemic – with an average surplus of $1.9 billion a year over the forward estimates.

Net debt as a share of the economy will also begin to decline from 2026-27 – and keep falling beyond that, with nominal net debt $2.1 billion lower by the end of the forward estimates compared to the 2024/25 Budget Update.

This Budget will also see Steps 1–3 of the Fiscal Strategy complete this year, and Step 4 on track to be delivered from 2026-27.

Importantly, it’s also an approach that will enable us to continue delivering what matters most to Victorian families.

Victoria’s fiscal strategy

✔ Step 1: Creating jobs, reducing unemployment and restoring economic growth.

✔ Step 2: Returning to an operating cash surplus.

✔ Step 3: Returning to operating surpluses.

➔ Step 4: Stabilising net debt levels as a proportion of GSP.

➔ Step 5: Reducing net debt as a proportion of GSP.

The Budget delivers an operating surplus in 2025-26 – the first time since before the pandemic – while net debt as a share of the economy is also on track to decline.

Updated